Debt Worksheet Printable - Fill out your debts from smallest to largest. Choose whether you want the spreadsheet in excel or google sheets format. Free printable debt snowball worksheet. The debt snowball method is as simple as writing down all of your debt accounts from lowest to highest and starting small.

10 Free Debt Snowball Worksheet Printables To Help You Get Out Of Debt

Debt Worksheet Printable

The author of the spreadsheet and the squawkfox blog, kerry taylor, paid off $17,000 in student loans over six months using this downloadable debt reduction spreadsheet. We can't help but recommend our own debt snowball worksheet ( you can download it for free here) as a great option if you're looking to track your debt payoff journey. You can either print it or fill it in online as a pdf, so it works no matter which format you prefer.

Circle Any Debts In Collections.

2 fill out the table to see your total monthly debt payment. The smallest debt will be the one that will be getting the snowball payment. Pay the minimum payment on every debt except the smallest.

Display It On Your Fridge, In Your Planner, Or On Your Desk To Stay Motivated And Focused On Your Financial Goals.

Pay as much money as possible to the smallest debt. Download the free debt snowball tracker pdf printable to easily keep track of all your debt payments. The second credit card is $9,000 at 9% interest.

Holiday Math Second Grade Worksheets

The problems represent a number of themes from the holiday season: Snowmen, reindeer, decorations, holiday snacks, jingle bells and. Meaningful and super e...

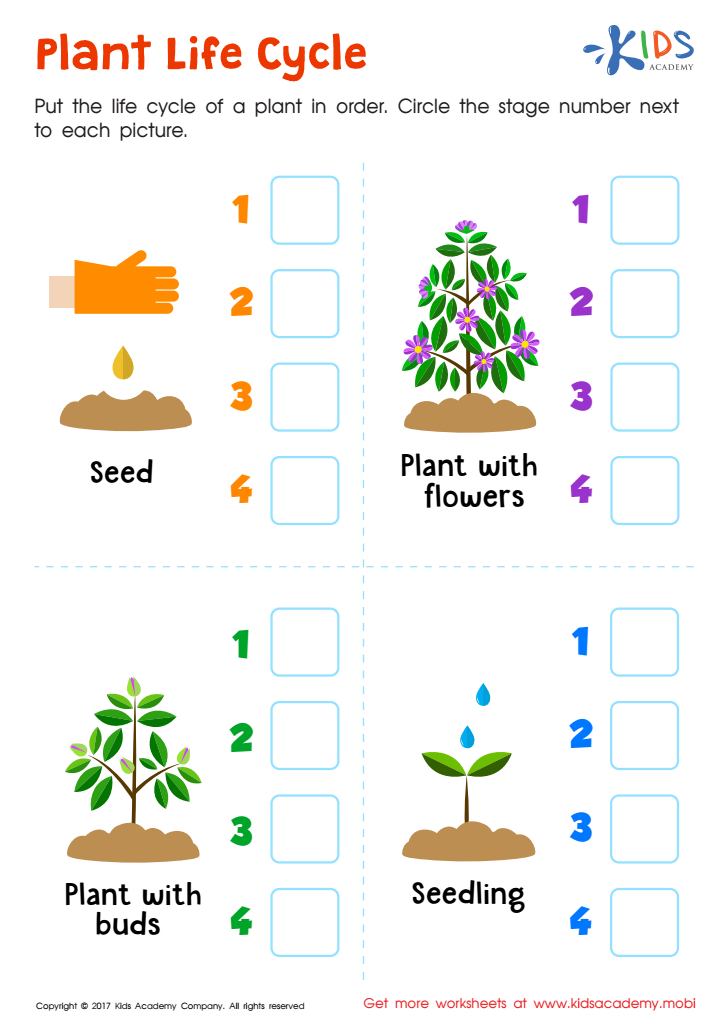

Life Cycle Of A Plant Printable Worksheet

Seed, germination, young plant, adult plant, and pollination. Language and educational level context: In this free set of life cycle printables, you'll rec...

You're Targeting The Debt With The Highest Interest Rate First.

The first free printable debt snowball worksheet is a tracking sheet. Debt snowball worksheet created date: You will also include your monthly payment and the amounts you have paid on it each month.

They Can Also Use Dbt Worksheets As Homework, Allowing Clients To Practice Their Newfound Skills Outside Therapy Settings.

How to use the debt snowball worksheet. It will help you organize and track all your debts, from those credit card balances to fogotten auto loans, making it easier to chip away at them and achieve financial freedom. Do the same for the second smallest debt untill that one is paid off as well.

Incorporating Dbt Worksheets Into Your Therapy Sessions And Daily Life Can Help You Overcome Challenging Situations And Emotions.

Your first credit card is $1000 at 12% interest. Worksheet debt list all your debts below starting from the smallest to the largest balance. When you pay off the smallest debt, add that minimum payment amount to your next smallest debt payment.

Start By Entering Your Creditors, Current Balance, Interest Rates, And Monthly Payments To See Your Current Total Debt, Average Interest Rate, And Average Monthly Interest Paid.

Continue as your snowball grows and. With the snowball method, you always start with the lowest payment first. With the debt snowball method, you pay off your smaller debt obligations first, thereby freeing up funds to pay off the larger amounts next until such a point where you are debt free for good.

List All The Debts You Have.

All you need to do is download and print the debt snowball tracker worksheets. That would look like this: On the left you write in the names of all your different debt sources, like credit cardx, car loan, student loan #1, student loan #2 etc.

This Variety Of Debt Trackers Also Includes Ones For Car Loans, Credit Card Debt, Mortgages, Student Loans, And Blank Ones That Allow A Variety Of Debt Sources To Be.

Write each one of your debts down on this form in order from smallest to largest. Now to see it in action, assume the following is your debt snowball strategy. If you don't have a surplus, then you need to find a way to reduce your expenses or increase your income.

Select The Appropriate Link From The Download Section Below.

Let's say, for example, you have four debts to pay off with the smallest amount being $50, the next $100, the next $150 and the last being $200. Debt snowball method tracker pdf. Seeing your progress over time helps keep you motivated and disciplined.

This Debtbuster Worksheet Works Best If You Put The Smallest Debt At The Top Of The List And The Biggest Debt At The.

This free printable debt payoff worksheet will be your personal financial sidekick. 10 free debt snowball worksheet printables money minded mom's debt payoff worksheets. Enter your list of debts in the table on the first tab of the worksheet (order does not matter)

In This Case, It Would Be Credit Card Debt Number 1.

Let's revisit the three debts from our snowball example, but this time, apply the avalanche method. If you have 1,000 a month to pay off debt, you will pay it out as the following: Debt snowball illustration & free printable debt payoff worksheet pdf.

Creditor Starting Balance Minimum Payment Date Payment Balance Creditor Starting Balance Minimum Payment Date Payment Balance Creditor Starting Balance

This free printable debt snowball worksheet is pretty easy to use. The first page in the kit is the debt snowball payments page. This process works, and you can see how effective it is on our printable guide.

The Set Includes A Debt Overview Sheet, A Debt Payoff Tracking Sheet, And A Debt Thermometer To Give You A Visual Of Your Progress As You Are Working On Paying Off Your Debts.

Free printable debt snowball worksheet debt name total amount owed minimum payment due debt snowball payment month 1 month 2 month 3 month 4 month 5 month 6 1. Put any extra dollar amount into your smallest debt until it is paid off. A couple of quick ways to cut expenses is to get rid of cable or at the very least downgrade your package to the bare essentials.

List The Balance, Interest Rate, And Minimum Payment.

Month 1 of your debt snowball. $1,000 ($50 minimum payment) + $740. 15 printable dbt worksheets and handouts.

Enter Your Debt Repayment Plan Start Date On The First Tab Of The Worksheet.

The first new download is a debt payoff worksheet that is available as a printable pdf. On the second page is a debt tracker that lets you record your own. You'll list the creditor at the top, and then there are columns to record your starting balance, interest rate.

How To Use The Debt Snowball Worksheets.

Use this debt worksheet to see all your bills and plan what you owe. I share free planning and organizing printables every week. You can use one worksheet per debt, and you can use this regardless of what debt payoff approach you choose ( debt snowball vs.

Pay The Minimum Payment For All Your Debts Except For The Smallest One.

In month one, you would pay the minimum payments to debts 2, 3, and 4. Here you will list all of your debts from smallest to largest. However, on debt 1, you would pay the minimum payment plus an additional $740.

Write Down The Amount You Plan To Pay On That Debt Each Month.

Debt Spreadsheet inside A Free Debt Reduction Worksheet That's Simple

Printable Debt Payoff Planner

Free Printable Debt Payoff Worksheet Pdf

Paying off Debt Worksheets

10 Free Debt Snowball Worksheet Printables to Help You Get Out Of Debt

Free Printable Debt Payoff Worksheet Free Printable

Printable Debt Worksheet

30++ Debt Payoff Worksheet Pdf Worksheets Decoomo

Debt Payoff Worksheet Debt payoff worksheet, Debt payoff, Payoff

Printable Debt Worksheet

Debt Worksheet Printable

10 Free Debt Snowball Worksheet Printables to Help You Get Out Of Debt

Monthly Debt Payments Worksheet Moms Budget

Debt Trackers & Debt Snowball Worksheets 35 Pages Printabulls

![]()

Free Printable Debt Tracking Sheets