Ssa Benifits Worksheet For Income Tax Printable - Up to 85% of social security becomes taxable when all your other income plus 1/2 your social security,. Information about notice 703, read this to see if your social security benefits may be taxable, including recent updates, related forms and instructions on. We developed this worksheet for you to see if your benefits may be taxable for 2023. 2020 social security taxable benefits worksheet.

Irs Social Security Benefits Worksheet 2022

Ssa Benifits Worksheet For Income Tax Printable

This usually happens if you have enough other income, such as other retirement income (e.g., pen. Fill in lines a through e. Annual social security amount (eg.

Worksheet To Determine If Benefits May Be Taxable A) Amount Of Social Security Or Railroad Retirement Benefits.

Amount of social security or railroad retirement benefits a) $11,000. You may have to pay federal income taxes on your social security benefits. If you are married filing separately and you lived.

To View The Social Security Benefits Worksheet:

You don't need to figure or include the worksheet. Worksheet to determine if benefits may be taxable. / v if you are married filing separately and you lived apart.

Holiday Math Second Grade Worksheets

Web holidays are a great opportunity to grab children’s attention and show them how fun and relevant math practice can be all year long! Free 2nd grade h...

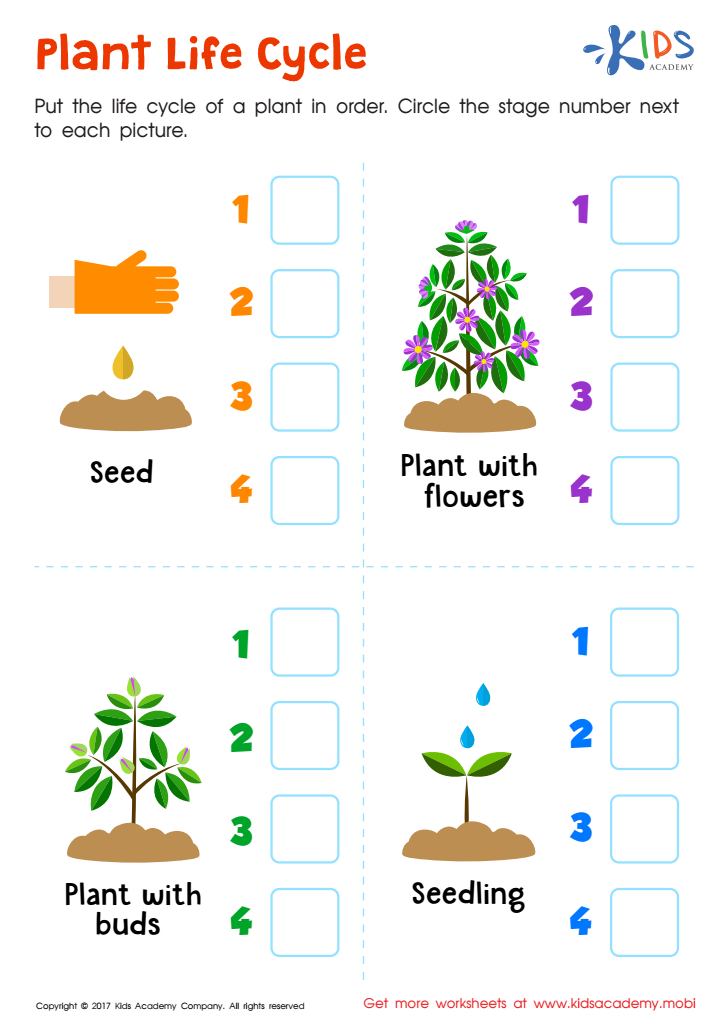

Life Cycle Of A Plant Printable Worksheet

Our free printable readers for kids books. Learn about plant life cycles with this emergent reader printables that helpds kids learn about the life cycle o...

Do Not Use The Worksheet Below If Any Of The Following Apply To.

Keep for your records publication 915. Calculating how much of your social security is taxable. This federal worksheet is used by individuals to make calculations according to the line instructions contained in the t1 general income tax and benefit guide.

To Determine This Amount, The Irs.

Your Taxable Social Security (Form 1040, Line 6B) Can Be Anywhere From 0% To A Maximum Of 85% Of Your Total Benefits.

2022 social security taxable benefits worksheet. File a federal tax return as an individual and your combined income* is.

How To Calculate Federal Tax On Social Security Benefits

Social Security Benefits Worksheet 2020

Irs Social Security Benefits Worksheet 2022

Worksheet 1 Social Security Benefits Studying Worksheets

Social Security Benefits Worksheet Line 6a And 6b

Social Security Taxable Worksheet 2023

20++ Social Security Benefits Worksheet 2019 Worksheets Decoomo

Ssa Taxable Worksheet

Taxable Social Security Worksheets

Social Security Taxable Benefits Worksheet 2021

Social Security Taxable Worksheet 2022

Social Security Benefits Worksheet Lines 6a And 6b 2022

Fillable Form 1040 Social Security Benefits Worksheet Lines 20a And

How To Fill Out Social Security Benefits Worksheet

Printable Social Security Worksheet For Irs Form 1040a Printable